All of us want to achieve financial freedom but how come only a few people reach the zenith of financial independence?

Just thinking about being financially free is not enough. It should begin with a detailed plan and determination to commit to that plan. Americans lack these qualities today, the reason why only a few people have financial freedom.

To guide you in the right direction, here are five habits to be financially free.

Habits to Achieve Financial Freedom

Spend within your means

One of the best ways to achieve financial independence is to spend less than you earn. It pays to track your expenses, stick to your budget and ignore the Joneses, which is a challenge for most Americans.

It’s not worth it to spend money on things just to keep up with your friends and neighbors. Do you really need a new car or buy a new property? Just stick to what you need and cut the things that you don’t need to avoid overspending.

Avoid credit card debt

Most people refer to credit card debt as the bane of financial freedom. Using credit cards to buy goods that you consume every day and carry a balance means that you are enriching banks and not yourself. A credit card is, in fact, is an example of money-generating machines.

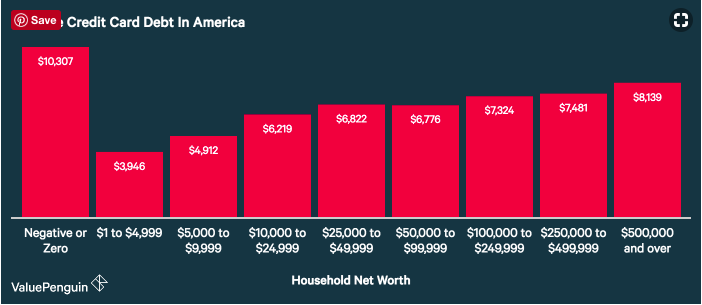

By looking at the data provided by Survey of Consumer Finances by the U.S. Federal Reserve, you can tell that people with the lowest net worth (zero or negative) have an average credit card debt of $10,308.

Here are other important credit card debt key findings:

- Average American Household Debt: $5,700. Average for balance-carrying households: $16,048

- Total Outstanding U.S. Consumer Debt: $3.9 trillion. Total revolving debt:$1,022 billion

- 38.1% of all households carry some credit card debt.

- Households with the lowest net worth (zero or negative) hold an average of $10,308 in credit card debt.

- The Northeast and West Coast hold the highest average credit card debt – both averaging over $8,000.

Put yourself first

This might sound selfish, but to reach financial independence, you need to put yourself first. It’s important to prioritize saving money, having emergency funds, funding an employer-sponsored 401(k) plan and buying insurance products that will help secure your future.

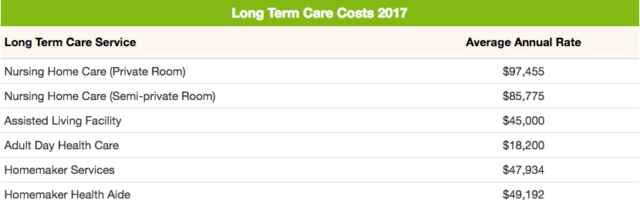

You need to consider your future needs and retirement expenses that might put a dent in your savings and make you become a burden to your loved ones later on. Buying insurance products like health insurance and long term care insurance is wise considering that the cost of healthcare and long term care expenses are increasing nowadays.

To give you an idea, here’s a table of the current cost of long term care by state:

Always save money

Most people say that they’ll start saving money when they reach this age or when they reach a point they are comfortable in putting aside money for their future.

But the problem is that “when” never comes. People should stop putting on hold saving money because there’s no perfect time to save money. Do it now no matter what your income is. Saving money is one of the best financial independence strategies that can guarantee to give you a bright future ahead of you.

Stop making excuses and save money now.

Make sure that your career or business is moving forward

Increasing your income steadily and maintaining a low or moderate spending level can help you reach your financial goals quickly.

You can take your career to the next level by improving your work skills and making yourself valuable to your employer and company. It’s also advisable to work hard and make yourself eligible for promotions. If you have your own business, it will help if you keep up with the latest business trends so that you can make your business move forward.