Last Updated On:

One of the most overlooked factors when planning for retirement is helping elderly parents financially. Most often than not, people are too consumed to meet their goals by saving enough for their future to have a comfortable retirement that they forget to check on their aging parents.

If your parents’ savings and assets are not enough for their retirement journey, you may end up taking care of them and helping them with their finances, which can derail your retirement plan.

Is it possible to help them financially without going broke?

Yes, and here are 11 tips you can follow so you and your elderly parents can enjoy a comfortable retirement:

11 Secrets to Helping Elderly Parents Financially

1. Start Retirement Conversation with Parents

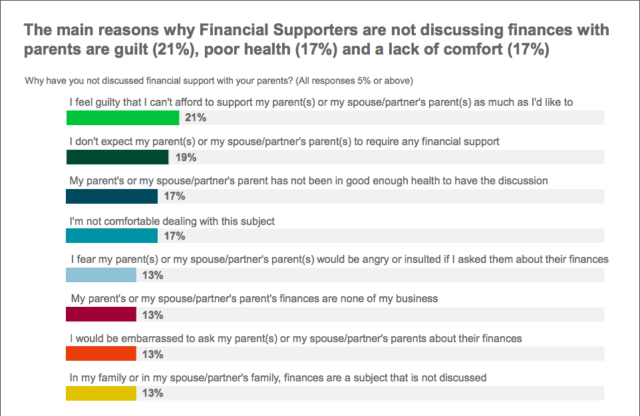

Starting a conversation about money with your parents is always hard. Most elderly parents are not comfortable discussing their finances even with their children.

It may seem petty, but elderly parents have reasons why they don’t talk about finances. One reason is that they think their children are only concerned about their inheritance. Another reason is the reversal of role, which reduces the role of parents to a child.

These are other reasons why adult children don’t discuss finances with their elderly parents.

Talking to your parents is hard, but it’s inevitable. They would rather go through self-impoverishment than to become a financial burden. You cannot expect them to ask for financial help, so take the initiative and start a conversation about money with them.

Since it is a sensitive topic, the best approach is to speak honestly and raise your concerns as briefly as possible.

Here are some tips that can start retirement conversation with parents

- Talk about your situation

- Be creative and use a story

- Ask the help of a third party or a professional

- Offer to help them create a spending plan

- Give them control whenever possible

- Keep the conversation brief but concise

2. Assess their Retirement Income

You need to dig deeper if you want to help your parents enjoy retirement. Taking a proactive role can make this task easier. You can offer to help them apply for Social Security if they haven’t done it yet, review their portfolios, check any pension information.

Since this is a touchy subject, assure your elderly parents that your utmost concern is they’ll have enough retirement income to live a comfortable life later on.

If you notice that their income will most likely fall short, make sure to give them options that can maximize what they already have or what can give an additional boost to their retirement income.

3. Change Spending Habits/Cut Expenses

Most elderly parents are naturally frugal, but there are still some parents who find it difficult to manage their money. Counseling them on how to change their spending habits and cutting unnecessary expenses is essential considering that retirement expenses are known to be very expensive.

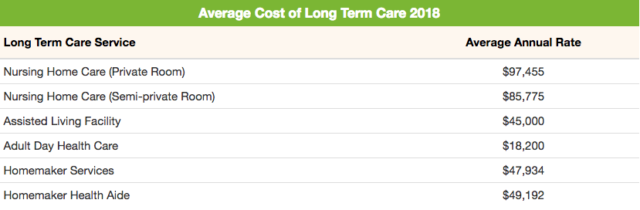

One of the most overlooked expenses is long-term care. Most people think that Medicare or Medicaid will cover home care, nursing home and other types of long term care services. Unfortunately, it’s just a myth since these government programs don’t pay for long term care.

Elderly parents need to follow essential money tips of Money Visual personal finance and change their spending priorities when retirement comes to prepare for long term care, medical bills, and other devastating expenses.

4. Downsizing Homes

Asking your parents to downsize living arrangement is another difficult task. Most elderly are reluctant to leave their homes even if it’s becoming a financial strain for them. You need to persuade them to move to a smaller home that is less expensive and low-maintenance.

Another reason to change living arrangements is to make sure that your elderly parents will have a comfortable and safe home. They want to retain independence, but there will come a time when they can no longer carry out their daily living activities. This is the time when retirement homes, nursing homes, assisted living facilities and other long term care facilities to come into the picture.

5. Plan for Long-Term Care

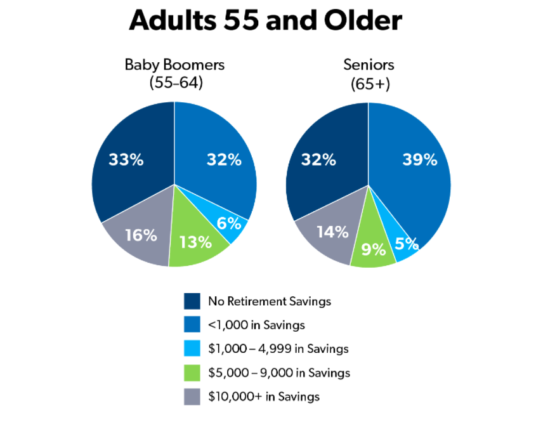

Most parents underestimate the risk of requiring long term care in the future. Around 70% of Americans turning 65 and above will require any form of long-term care.

Aside from the fact that it will most likely become a need for most parents, another concern would be the cost of long term care. The cost of care continues to rise, which makes it harder for people to afford this without a proper plan or a long-term care insurance policy in place since Medicare and health insurance do not pay for long-term care. Medicaid provides limited coverage but only to people with income that is little to none.

Did you know that: You could save up to 30% on long-term care insurance in less than 1 minute?

6. Make Sure their Policies are Updated

Find out if your parents have already purchased policies to cover medical expenses, long term care, and other healthcare expenses. If they don’t have any policy, then persuade them to purchase one before it’s too late.

It is important to convince your parents to buy a policy because if they don’t have financial protection, you will end up paying for their care expenses, which can derail your plans. One area you should focus on is long term care since the cost of nursing homes, assisted living facilities, CCRCs and other long term care facilities are rising.

Here’s a sample computation of the cost of long term care insurance today:

- A 55-year-old male who is single will have to pay $1,870 annually to receive benefits that would be worth $386,500 when he turns 85.

- A 55-year-old female who is single will have to pay $2,965 annually to receive benefits that would be worth $386,500 when she turns 85.

Did you know: A couple both age 55 has an annual premium estimate of $2,070 each for a policy with $200 daily benefit that would last to 4 years.

7. Ask Siblings for Help

Asking for help is not a sign of weakness. This only means you want the best for your elderly parents.

If your siblings are in a better position or they can afford to contribute, then you can ask them to chip in.

If your siblings are also financially challenged like your parents, they can help in other ways like by taking care of them, doing errands or making sure that the house is well maintained and safe for your parents.

8. Take Advantage of Tax Breaks

Some medical expenses of the elderly are tax-deductible. If you’re taking care of your parents, you can avail of tax breaks given to family caregivers.

Make sure that you can claim that your parents are your dependents. Another requirement is that you must be paying at least half of their living expenses. If you meet the eligibility requirements, then the 7.5% rule will be applied.

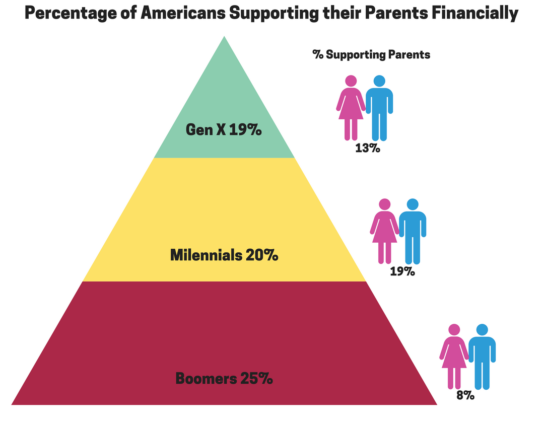

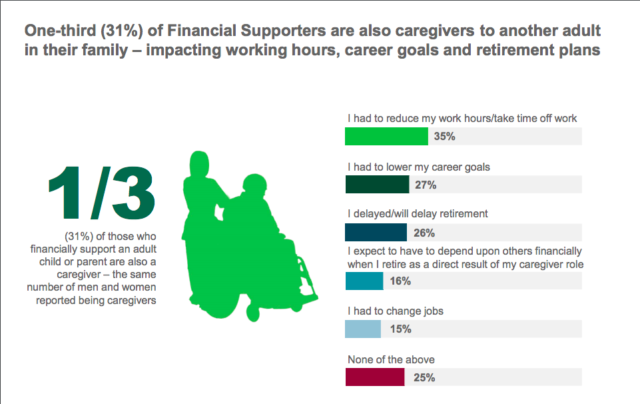

Adult children helping elderly parents are becoming common in the United States today. It’s too common that more adult children are struggling to keep up with their finances and they need to make necessary changes in their working hours, goals and even their retirement plans.

Read: 13 Smart Ways to Spend Tax Refund in 2018

9. Avoid Financial Scams

Financial scams among the elderly are rampant nowadays. They prey on old people because they are easy to persuade, primarily because of their declining mental health, which hinders them from making sound decisions.

Educate your parents about these schemes and always remind them to transact with reliable sources only. You should also keep track of their spending habits to be sure that their investments will not fall into the wrong hands.

10. Consult a Retirement Expert

Consulting a professional is always a good idea. Introduce your parents to a retirement expert that can help them create a solid retirement plan.

But make sure that the retirement expert will not force your parents to buy a certain policy for their financial gain. It’s best to ask recommendations from other family members, friends and people you trust regarding a reliable adviser in your area.

Related: 50 Tips from Retirement Experts (Expert Roundup)

11. Plan for your Retirement

Helping elderly parents financially is not an excuse not to have a retirement plan. You should keep your future in mind by planning for long-term care and health care needs while helping your elderly parents. If not, then the cycle will just continue, and you will end up relying on your children later on because you spent all your money supporting your parents.

Make it clear to your parents that you want to help them, but you have other responsibilities too and a future that you need to plan for. Don’t be shy to ask for help from your siblings if you can’t carry the burden on your own. It’s okay to set some limits because this will benefit you greatly someday.

Final Thoughts

No matter how busy you are, it pays to check on your aging parents especially their financial health. Because if you don’t, they might end up living with you and taking care of them as well as their finances. So, while it’s still early, start helping your aging parents plan for their future long-term care, health care, and retirement needs so you can help them with their finances without going broke.

We can help your aging parents plan for their long-term care needs by helping them compare coverage options premiums and policy benefits. Help your parents now by requesting for no-obligation quotes or by calling us at 800-362-8837.