Long term care refers to the services and support that an individual might need to maintain his or her quality of life in the event of illness, disability, or sudden impairment. This type of ltc covers the assistance in completing the Activities of Daily Living or ADL. These tasks include the following:

- Eating

- Bathing

- Dressing

- Toileting

- Continence

- Transferring

While the definition of long-term care might lead some people to think that it is the same as medical care, these two are different. On one hand, medical care concentrates on treating the illness in order to improve health. On the other hand, ltc focuses more on maintaining the person’s functionality and routine.

Other forms of long term care services include support in completing everyday tasks called Instrumental Activities of Daily Living or IADL such as:

- Household chores

- Medication management

- Meal preparation

- Grocery shopping

- Making phone calls

- Caring for pets

As illustrated in this infographic, the lack of long-term care policy can have severe consequences like outliving your savings or asking for help from your family. However, planning for health care and long term care can be overwhelming with the abundance of information available online. To make the process easier, use these basic long term care information to help you with planning.

Who Needs Long-Term Care?

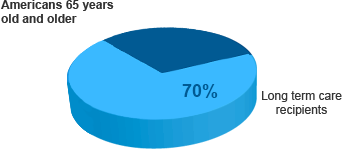

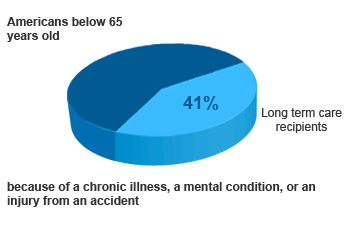

7 out of 10 of Americans 65 years old and above will need some form of long-term care. But, long-term care is not just for the aging population. Around 41% of working adults below 65 years old will also need long-term care because of a chronic illness, a mental condition, or an injury from an accident.

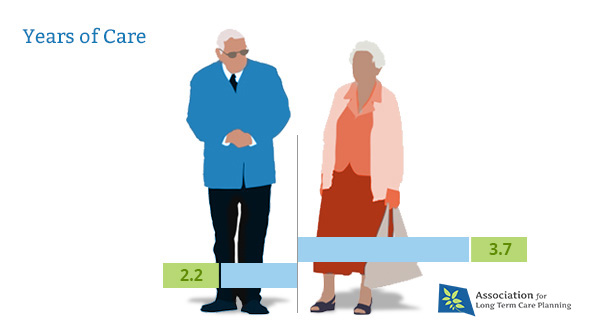

The average years a man and a woman would need long term care are as follows:

Average Length of Stay in Assisted Living Facility

According to the 2010 Investment Guide of the National Investment Center (NIC), the average length of stay of residents in an assisted living facility is 29 months or approximately 2.5 to 3 years.

Average Length of Stay in Nursing Home Facility

According to Centers for Disease Control and Prevention, the average length of stay in a nursing home is 835 days or more than two years. But, it is a different story if the care recipient has a cognitive condition. Those who are suffering from Dementia or Alzheimer’s can stay in a nursing home for five years.

Who Pays for Long-Term Care?

Some middle income and affluent families buy long-term care insurance to pay for home care, nursing home, assisted living and other long-term care services. Low-income families rely on Medicaid, which provides long term care coverage to people who meet its eligibility requirements.

It is important to clearly understand who is responsible for paying for long term care since there are a lot of misconceptions about what government program helps pay for long term care. Is it Medicare? Medicaid? Now, it’s time to separate long term care facts from myths.

Medicare

Medicare doesn’t pay for custodial care or most long-term care services that provide help in carrying out Activities of Daily Living (ADL) such as eating, bathing, and toileting.

But, Medicare pays for long term care that requires skilled or rehabilitative care provided that the care recipient meets these requirements:

- You are receiving skilled home health or other in-home ltc services for a short period of time.

- You can stay in a nursing home for a maximum of 100 days but Medicare will only cover your skilled care expenses for 22 days.

Medicaid

Medicaid pays for long-term care services but only if you are eligible for benefits and that means your income must be below what your state requires. Other requirements you must meet are the amount of assistance you will need ADL.

Long-term care insurance policy

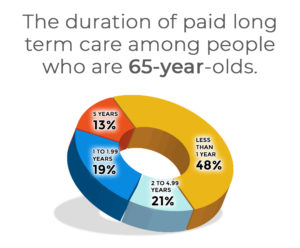

Considering the expensive cost of long term care, it is best to assume that you will stay in a nursing home or assisted living facility for two to three years and prepare for it by getting long-term care insurance coverage.

Check out our Comprehensive Guide on How to Pay for Long Term Care.