As we start a New Year, it’s the perfect time to think about your financial safety, particularly about owning long term care insurance. 2019 is still young, which gives you an opportunity to address your future long term care needs.

According to Association for Long Term Care Planning, around 7 out of 10 of Americans 65 years old and up will need some form of long term care. The need for long term care is looming, but are we prepared for it?

Long Term Care Insurance Explained

Long term care insurance is defined as a policy that helps pay for long term care supports and services that they will need due to old age, illness, injury or accident.

A policyholder must require assistance with at least two of the six ADLs – eating, bathing, dressing, toileting, transporting and incontinence, and wait until the elimination period of the policy before long term care insurance starts to pay for benefits.

Despite this looming crisis, only 8% of Americans managed to purchase long term care insurance. Are we still in denial of this need or long term care insurance policy is not a wise purchase.

To help you decide, you need to take a closer look at long term care insurance pros and cons first.

Related: What Does Long Term Care Insurance Cover?

The Pros of Long Term Care Insurance

1. Afford Quality Long Term Care

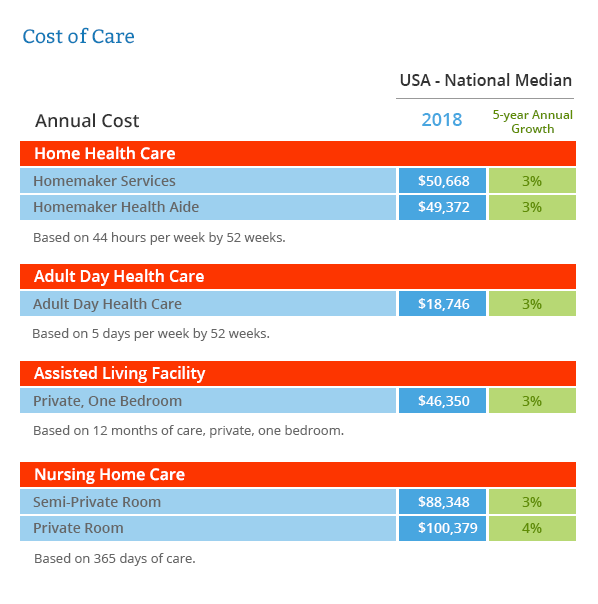

Long term care cost continues to rise. The average annual cost of a private room in a nursing home is $100,379 while a private room has an average annual cost of $88,348 according to ALTCP’s cost of long term care.

Without a policy in place, you will be forced to find an option that fits your limited budget. This means moving in a facility with an environment you don’t like and receive mediocre care.

Things will be better if you have a long term care policy that can help you afford long term care services and facilities that can provide you with high-quality care.

2. Maintain Independence

Did you know that long term care insurance pays for in-home care?

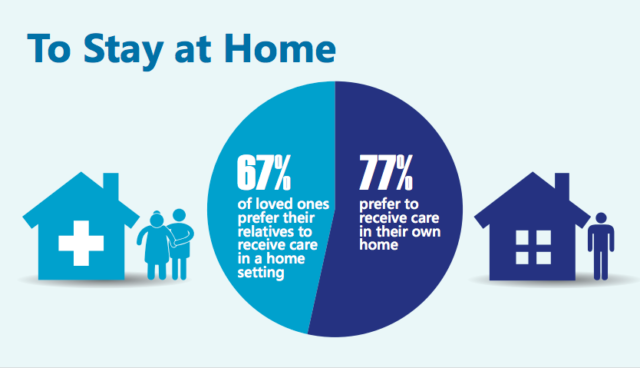

There are still some Americans who think that this policy only pays for nursing homes. It actually helps pay for a variety of long term care facilities and services including assisted living, CCRC, adult day care and in-home care.

Owning a long term care policy will come in handy for majority of the aging population since 77% of them prefer to receive care at home. They can maintain their independence since they can receive care at the comfort of their own homes.

This benefit alone makes long term care coverage an easy choice among individuals.

Read Next: Monthly Digest: Analyzing the Appeal of Aging in Place

3. Reduces Financial and Emotional Stress Caused by a Long Term Care Event

There are around 34.2 million family caregivers have provided unpaid care to an individual 50 years old and up according to a report by the National Alliance for Caregiving and AARP. Majority of these family caregivers are female who have other responsibilities including taking care of children, working, household chores and others.

Family caregiving has substantial implications in an individual’s life and they are the following:

- 1 In 5 caregivers experiences high levels of physical strain

- 2 in 5 caregivers experience emotional stress

- 1 in 5 caregivers experiences financial problems

- 3 in 5 working caregivers have experienced at least one impact in their employment situation

According to a report by AARP, family caregivers spend an average of around $7,000 annually for out-of-pocket costs related to caregiving. This is equivalent to nearly 20% of what family caregivers are earning.

You can spare your loved ones from caregiving duties and financial toll of caregiving by owning a long term care insurance policy.

Read: 5 Ways to Ease Financial Burden of Caregiving to Women as Primary Caregivers

4. Tax Benefits

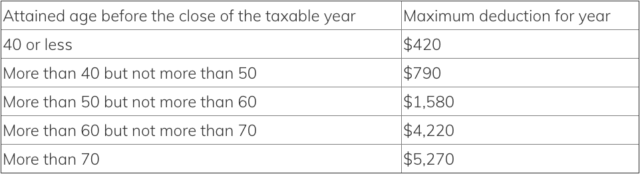

Premiums paid for long term care insurance are qualified for tax deductions. As a matter of fact, these are incentives given by the Federal Government to encourage individuals to buy tax-qualified long term care policies. Also, it is the government’s way to lighten the load of Medicaid for paying for long term care expenses.

To qualify for long term care insurance tax deductions, your policy should be issued on or after January 1, 1997 and must meet certain requirements such as the policy must offer the policyholder the option of nonforfeiture and inflation protection, although the policyholder can decline to buy these features. If the policy was purchased before January 1, 1997, it will be grandfathered and will be considered as qualified as long as the insurance commissioner of the state in which it was sold will approve it.

However, there are tax deductibility limits that depend on the taxpayer’s age at the end of the year. Premiums for the year that exceed these limits will not be considered as a medical expense and will not be considered as a tax deduction.

Family caregivers can also avail of tax breaks as long as they can prove that their parents are their dependents and that they shoulder at least half of their living expenses.

5. Peace of Mind

Owning a policy can give you peace of mind since it helps you combat fears of getting old and being vulnerable to illness, financial dependence on loved ones and other senior-living stereotypes.

There is a certain level of peace of mind that arises from the fact that you have coverage and you are well protected in case you will need long term care later in life.

Cons of Long Term Care Insurance

1. Cost

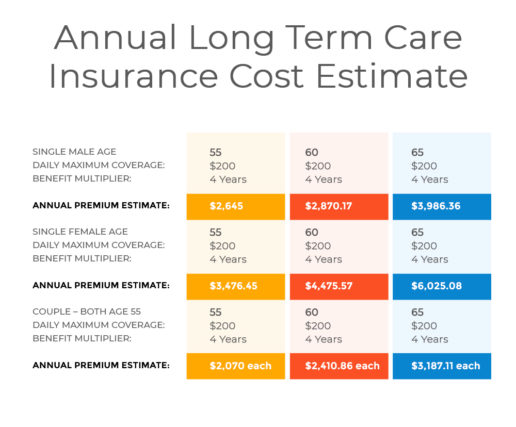

Some would say outright that long term care insurance is expensive. In fact, it’s possible to buy a policy at an affordable price.

How?

Buying long term care insurance as early as in your 50s can help you save on premiums. Insurance companies prefer to give discounts to applicants who are younger and healthier since they will less likely use their policy anytime soon.

Another way to save on premiums is by availing spousal discounts. You can save up to 30% on your premiums if you and your spouse buy coverage from one insurer.

But take note that women have higher premiums than men because they live longer than men.

Here are the average cost of long term care insurance based on age, gender, and daily benefit.

2. Premiums Can Go Up

The price of long term care insurance is not guaranteed and can go up. Price hikes happen because old policies were priced lower and insurance companies underestimated the number of people who will use the product. Since long term care insurance companies are under a lot of pressure, they increase their premiums.

But there’s no need to worry because your insurance provider cannot increase your premiums just because you filed for a claim. Premium hikes are also rare and it will not happen for 10 years or more. In case it happens, the premium hikes will be 10% to 20%.

The companies we work with never had premium hikes. You can request free quotes and start comparing companies and rates with no pressure to purchase.

Related: 5 Ways to Deal with Long Term Care Insurance Rate Increases

3. Qualifying for Coverage

Same with other types of insurance, you need to qualify for long term care insurance first. There are pre-existing conditions that would make it impossible for you to qualify for a policy. If you wait too long to get coverage, you might develop an illness that will disqualify you as well.

Here are some conditions why applicants are denied long term care coverage.

- AIDS/HIV+

- Alzheimer’s

- Amputation due to disease

- Amyotrophic Lateral Sclerosis (ALS or Lou Gehrig’s Disease)

- Cancer of bone, brain, esophagus, liver, pancreas, stomach

- Cirrhosis of the liver

- Congestive Heart Failure (CHF)

- Cystic Fibrosis

- Dementia

- Frequent/Persistent forgetfulness or memory loss

- Huntington’s Chorea

- Chronic Kidney Disease

- Metastatic Cancer (spread from original site)

- Multiple Sclerosis

- Muscular Dystrophy

- Organ Transplant other than kidney or cornea

- Organic Brain Syndrome

- Paralysis

- Parkinson’s Disease

- Scleroderma

- Schizophrenia or other forms of Psychosis

- Systemic Lupus

- Transient Ischemic Attack (TIA) within two years or more than one TIA

4. You Might Not Need It

Another drawback of long term care insurance is that you might not need it. Although, there might be a slim chance since 70% of Americans 65 years old and up will require some form of long term care.

But having coverage for long term care is still better than to put your savings and loved ones on the line.

5. Policy Exclusions

Long term care insurance doesn’t cover all types of conditions and diseases. There are certain policy exclusions that you should be aware of and they are the following.

- alcoholism and drug addiction;

- attempted suicide or intentionally self-inflicted injuries;

- war or an act of war, whether declared or undeclared;

- participation in a riot, felony, or insurrection;

- service in the armed forces; or

- aviation activities if not a fare-paying passenger

Final Word

The pros of long term care insurance allow you to afford high-quality care, protects your assets and your loved ones and gives you peace of mind while the cons are closely linked to high premiums.

It’s harder to find yourself in the middle of a financial turmoil and in the brink of asking help from family members than to plan ahead and actually do something before a long term care crisis arise.

If you still need help assessing your situation, we at ALTCP can make recommendations of the best long term care insurance providers we represent. We can help you find the best policy at the right price based on your goals and needs.