Mother’s day is fast approaching, and it is around this time that children begin searching for the perfect gift for Mom. Although handbags, bouquets of her favorite flowers, and heartfelt notecards always do the trick, consider an unconventional but practical gift that she and Dad will benefit from for years to come. Naturally, we are talking about a long-term care policy.

After all, a comprehensive long-term care coverage that protects an individual’s family members and assets from the substantial costs of care is the goal, isn’t it? After all the years that Mom has spent caring for us, it is about time that we return the love. However, it is understandably intimidating to invest in something as big as long-term care insurance. This is why ALTCP has always been adamant about health literacy. One of our main goals has always been to encourage learning about a policy before purchasing.

To assist you in understanding the basics of a policy, here are questions to ask when buying long-term care insurance. These will act as a guide as you discover and learn about the world of long-term care policies.

Who Will Care For Mom?

Mother, Mom, Mama, or even Mummy—we all have one, whether we are related by blood or not. When we were younger, we would always run to our mothers when we get into accidents or get sick. Mothers, because of their nurturing nature, have a way of making it all better. Even now that most of us are grown and starting families of our own, Mom always wants to be there when something happens. And more importantly, we would always want our mothers to be there. However, in the process of growing up and leading busy lives, many of us seem to have forgotten that our mothers are also growing older. Along with these life stages come various health conditions and limitations that were not there years before.

Suddenly, Mom’s unable to drive to the market on her own. She forgets her appointments and fumbles for names and dates she has always known by heart. Sometimes, even the unimaginable can happen. You get a call telling you that your mother fell and busted her hip or experienced a stroke.

These are the harsh realities that no one wants to consider ever happening to their parents. In many children’s eyes, mothers are indestructible. However, that is not really the case, is it? When any of these situations happen, who is going to care for her?

Understanding the Cost of Care in the United States

When posed with the question above, children often readily step up to take on the responsibility of care. After all, this Mom we are talking about, right? She dedicated so much of her life providing the care that we needed, so a handful of years caring for her would only seem right.

However, we ask you to stop and think about the repercussions first. It is a widely-known fact that the costs of long-term care services are increasing at a rapid pace in the United States. So many older adults and their families are struggling to keep up with the expenses.

According to the 2016 Cost of Care Survey, the median monthly prices of long-term care services are as follows:

- Homemaker Services – $3,813

- Home Health Aide – $3,861

- Adult Day Health Care – $1,473

- Assisted Living Facility – $3,628

- Semi-Private Room at a Nursing Home – $6,844

- Private Room at a Nursing Home – $7,698

Bear in mind that these are just the average costs. In some states, like Alaska, rooms at nursing homes can go up to more than $24,000 a month.

What makes matters even more concerning is that long-term care needs can last for years. Typically, men need 2.2 years of care, while women need these services for 3.7 years. As you can see, the odds are not in Mom’s favor.

Women end up paying more when it comes to long-term care services because they live longer, which means that they end up needing more care. In fact, research shows that 70% of nursing home residents are women.

Long-Term Care Costs More than Money

As mentioned above, people are now living much longer lives compared to those a few decades ago. Although it should be celebrated, these additional years could easily turn into more sick years, which would translate to thousands of dollars down the drain. Judging from the figures stated earlier, we are all one diagnosis away from bankruptcy.

This is why older adults cite outliving their savings as one of their top fears about aging. In fact, 43% of older adults have confessed to fear running out of money more than dying.

When this happens, older adults may have no other choice but to rely on their children for support. Now this situation affects both parties. Adult children suddenly find themselves becoming the unprepared family caregivers to aging loved ones. Yes, caregiving may be a rewarding experience because you get the opportunity to give back to loved ones. However, these circumstances can put your well-being at risk. Caregivers develop or aggravate health conditions because of the demands of care. They are also at a high risk of mental conditions such as depression.

On top of that, high-hour caregivers quit their jobs or postpone starting a family to fulfill the role full-time. Since their loved one’s long term needs can last for a few years, caregivers may find it hard to secure another job after. The demands may also leave little room to find a partner to start a family with. Caregivers delay starting their own families or even end up alone because they have spent a big portion of their days providing care.

How Can a Long-Term Care Policy Help?

All of these circumstances and situations are just brief glimpses of how long-term care can affect a person and a family. It does not just impact the individuals, but the generations after them. What makes this even more terrifying is that this may be what is in store for your loved ones—especially our mothers. Research points out that 70% of people will need long-term care services at some point after turning 65 years old. This excludes the larger number of people younger than 64 who find themselves needed care, as well. It is a situation that is close to impossible to avoid despite living a healthy lifestyle.

Many, however, are considering self-insurance. This is when you use your own assets and resources to fund the care that you need. While an obvious advantage of this choice is that you will not have to worry about premiums, bear in mind the risks involved. One miscalculation can lead to a financial disaster. Long-term care costs are increasing, and they can be unpredictable. Relying on your just your savings may be a dangerous decision to make. What more if you are deciding for some else?

Finding a good long-term care policy is absolutely vital at this point. These plans provide the security and peace of mind in knowing that should anything happen to our mothers, their policies will protect them by paying for the expenses that they incur. This safety-net keeps her assets and savings intact and her children safe from the devastating blows of care.

However, we understand that many are still hesitant to secure a policy because of the premium costs. Yes, they can be expensive, but there are ways in which these numbers can be decreased to a more manageable amount. Before you purchase a policy on long-term care, be sure to consult with the industry experts thoroughly. Strive to understand the concepts and terminology in order to ensure that you get the benefits that Mom needs. Also, remember that an overloaded long-term care policy will not do anyone in your family favors. Too many riders mean more dollars to pay, so be sure to include the ones you think your mother will need.

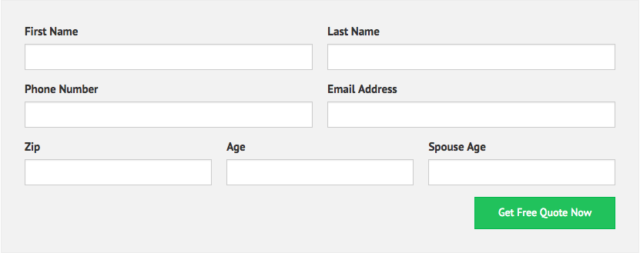

To secure a long-term care policy for your mother, you can start by request for an instant long-term care insurance quote now.

Add More Meaning to Mother’s Day

It is an unconventional gift for Mother’s day, but it does say a lot. You care for your mother, and you want her to be protected from the dreary future that may be just around the corner. After all, no one wants to the see their mother—the person who has fought so hard for her children to get to where they are now—suffer for care services that she needs. No, that should not be their reality, and we have the power in our hands to help them discover another path. What better way to at least start the conversation about long-term care coverage than on Mother’s Day?

Remember that we can show our love and give back in ways that do not require sacrificing our well-being. Yes, these individuals may not have had any choice, but we do, so let’s take it.