Those who think that they can rely on Medicaid to pay for their long term care needs should think twice before putting all their faith in this government program.

Why?

Americans often misunderstood the long term care benefits of Medicaid. It doesn’t work the same as long term care insurance, a policy that helps pay for long term care services and facilities because of illness, old age, accident or injury.

Unfortunately, many Americans who plan to use Medicaid are not aware of this. In fact, 44% of adults 40-54 years old and 41% of adults 55-64 years old expect that they will need Medicaid.

Before you decide to use Medicaid to pay for your long term care expenses, make sure to understand how it works first and how it differs from a long term care policy.

What is Medicaid?

Medicaid is a government program designed to pay for different types of medical and custodial services to individuals who are financially challenged. It has a long term care benefit that is perfect for individuals who require long term care but have enough retirement savings and assets.

In order to become eligible for Medicaid benefits, individuals should only have $2,000 or below in liquid assets. But take note that eligibility requirements vary by state.

However, there are some people who opt to not to buy long term care insurance and just rely on Medicaid later on. It’s a great benefit that many people abuse by deliberately spending down their assets to qualify for Medicaid benefits. Little did they know that Medicaid is far from what they have imagined since it’s coverage is not the same that of long term care insurance.

Comparing Medicaid and Long Term Care Insurance Benefits

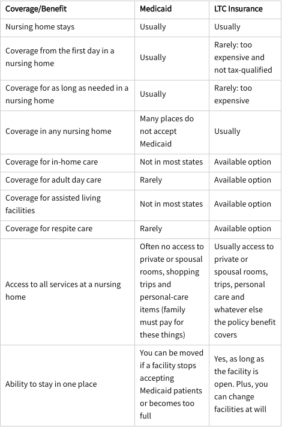

Medicaid provides some benefits that are not offered by most long term care insurance policies. There are also policies that offer flexibility and options not offered by Medicaid. Below you can find a chart comparing their differences on funding long term care.

In-Home Care

Many aging Americans prefer home care nowadays. In fact, 77% of older adults prefer to receive care at home because it is familiar and comfortable.

If you’re most people who prefer to age in place, having long term care is beneficial since it covers home care. In case you plan to use Medicaid and you own a home, better think twice. There’s a chance that your heirs will be forced to reimburse the cost of your care from the sale of your home when you receive care and your spouse who stayed at home dies. But this depends on your state’s rules.

Related: How to Save On In-Home Care Costs Without Compromising Quality of Care

Nursing Home

Medicaid covers nursing home stays for non-skilled custodial care, which means staying at home is not always an option if you’re eligible for Medicaid even if home care is more affordable and more than enough of what you need.

However, not all nursing homes accept Medicaid patients. In some cases, they accept Medicaid patients but you have limited options. There might be a special wing or floor for patients eligible for Medicaid, you can’t have a private room or you can’t have your spouse as your roommate.

Insurance for long term care provides you with more options. You can choose a semi-private room or a private room in a nursing home. But make sure that your benefit is high enough to cover your nursing home stay, which is usually 2 to 3 years.

Read Next: 6 Ways to Protect Assets from Nursing Home Costs

Assisted Living and Continuing Care Facilities or CCRCs

Those who prefer to maintain a bit of their independence while receiving some form of long term care will find assisted living beneficial. This type of facility is an apartment where you can receive care and assistance in doing some daily activities such as meal preparations, housekeeping help, and others.

Continuing care facilities take assisted living a notch higher because it has an on-site nursing home that makes the transition easier.

If you think assisted living will perfectly suit you well, it’s best to have a long term care policy.

Adult Day Care

There are cases wherein family members choose to take care of their loved ones but they can’t stay home during the day because of their other responsibilities. This is where adult day care comes in the picture. It works this way, family members drop their aging loved ones in the facility in the morning and then pick them up in the afternoon or evening.

Long term care insurance covers adult day care while Medicaid rarely covers it.

Final Word

Think twice before relying on Medicaid to pay your long term care expenses. It’s important to weigh your options carefully especially if your health and family are on the line. You might consider purchasing long term care insurance if you’re looking for a solution that provides more coverage options. If you’re still unsure what’s the best way to address your long term care needs, you can request a free consultation from us.